Communication with Shareholders and Investors

Basic Policy

Taikisha promptly discloses important information regarding Taikisha based on the transparency, fairness and consistency stated in the Taikisha Management Vision: “Conduct businesses under free and fair competition in compliance with laws and the spirit thereof; contribute to customer/ business partner, shareholder, employee, community/ society and global environment with transparency and integrity.” Based on such disclosed information, Taikisha holds constructive dialogues with shareholders, which contribute to sustainable growth and the medium- to long-term improvement of corporate value.

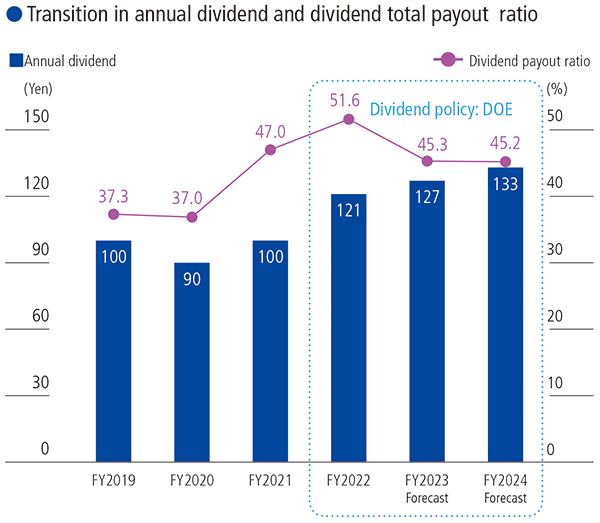

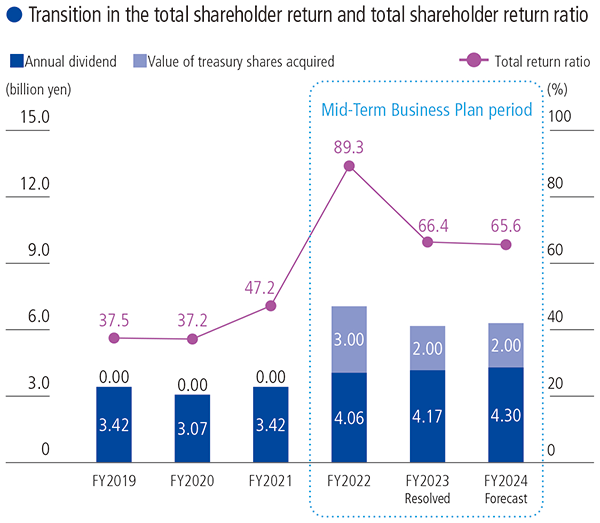

Basic Policy for Shareholder Returns

Based on the basic policy, Taikisha is working to improve corporate value through enhancement of shareholder return by changing dividend policy and purchasing treasury shares as stated in the Medium-Term Business Plan released in May 2025.

We continuously work to enhance the shareholder return based on the following policy.

- Dividend policy

-

- We consider the return of profits to shareholders through dividends to be one of our highest priorities, and aim to achieve a dividend on equity ratio (DOE) of 4.0% and stable dividends.

- Basic concept

DOE 4.0% = Aimed ROE level 10.0%×dividend payout ratio 40%

- Purchase of treasury shares

- We will flexibly purchase and retire treasury shares in order to improve capital efficiency and promptly implement financial policies.

- (Aim for roughly 2.0 billion yen’s worth per year)

Dialogue Status

With regard to the status of dialogue with investors in FY2023, Taikisha held dialogues with a wide range of institutional investors in Japan and overseas, mainly with portfolio managers and analysts from major investment funds. The Company assigned the Director in charge of Corporate Planning Headquarters to control dialogue with investors. In addition to the individual interviews held by departments in charge of IR, the Company held biannual financial results briefing sessions by the Company’s management team. Major interests of investors in these dialogues include the overview of operating performance as well as the construction demands in metropolitan area, trend of capital investments related to semiconductors and by automobile manufacturers, carbon neutrality-related technological development and growth strategy, progress of Medium-Term Business Plan, and views on capital policy and shareholder return. Interests and opinions of investors obtained through dialogue were fed back to the management team in a timely manner by department in charge of IR through reporting and distribution of report at the Management Meeting and the meeting of the Board of Directors to promote sharing and use of information in the Company.

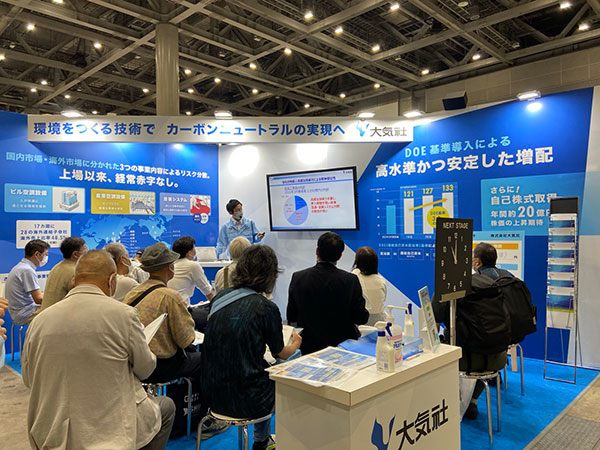

In addition to the dialogues with institutional investors, Taikisha held briefing sessions for individual investors led by the Chief Executive of Corporate Planning Headquarters several times to have opportunities to explain overview and strategy of each business of the Company and views on capital policy and shareholder return. These efforts serve as promoting active dialogue with individual investors.

The Nikkei IR Individual Investor Fair 2024

The Nikkei IR Individual Investor Fair 2024

External Evaluation

Selection for the ESG investment index

Taikisha has been selected as a constituent of the following ESG investment indices. Taikisha’s addition to the constituents of these indices, which place importance on ESG (environment, social and governance) evaluation by research firms, reflects its continuous engagement in ESG efforts

| ESG investment index | Overview of evaluation |

|---|---|

| MSCI Japan ESG Select Leaders Index | Adopted by GPIF. Index designed to select companies with high evaluation in ESG among the various industries in Japan. Selected for the second consecutive year since 2022. |

| FTSE Blossom Japan Sector Relative Index | Adopted by GPIF. Index that reflects the performance of Japanese companies that are well prepared for ESG issues. Selected for the second consecutive year since 2022. |

| S&P/JPX Carbon Efficient Index | Adopted by GPIF. Index that determines the weights of compositions by focusing on the carbon efficiency of companies. Selected for the third consecutive year since 2021. |

| Sompo Sustainability Index | Investment product managed by Sompo Asset Management Co., Ltd. The index invests in a wide range of businesses that had been highly evaluated in terms of ESG. Selected for the seventh consecutive year since 2018. |

-

*THE INCLUSION OF [TAIKISHA LTD.] IN ANY MSCI INDEX, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT OR PROMOTION OF [TAIKISHA LTD.] BY MSCI OR ANY OF ITS AFFILIATES. THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI OR ITS AFFILIATES.